NEPSE is Nepal government owned and the only stock exchange of Nepal. The number of people involved in NEPSE had been increasing steadily but since 2019, the number of people in both primary and secondary market has increased exponentially. Every IPO these days is highly oversubscribed. With the right strategy, patience and right calls, you can either make good some of active money or steady passive income depending upon your priority. Follow us and stay tuned for advice, tips and tricks about NEPSE, Trading, Investing and more, but for now, let get started with how to start trading in NEPSE, if you are a beginner.

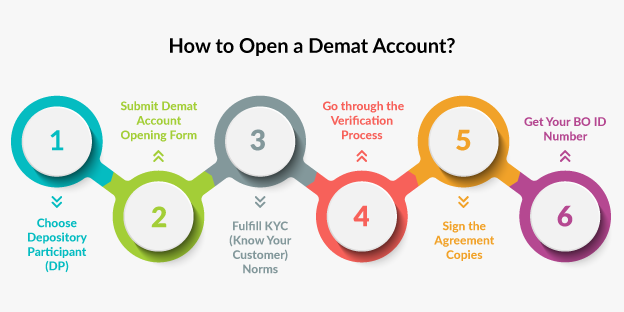

We’ll follow the following steps to start trading in NEPSE:

- Open a bank account

- Open a DEMAT account

- Get C-ASBA number (CRN)

- Create MeroShare account

- Create a broker account

Open a bank account

To start trading in NEPSE, you must have a bank account for various reasons that will discuss in detail soo. To manage stocks, we need to open a special type of account called “Demat” account, but having a bank account is pre-requisite to open a demat account, hence opening a bank account is necessary to start trading in stock market in Nepal.

You will need a bank account event when applying for IPOs, the amount of money that you have applied in the IPO is frozen in your bank account, and if not allotted, it is release back to your account. You also receive the dividend for the stocks you own in the bank account. If you’re reading this, it’s highly likely that you already have a bank account, but if you don’t have one yet, you should create an account with the bank that also has it’s own capital. Most A-class banks have their own capitals now, like NICA, Nabil, NIBL, Century, Siddhartha, Laxmi and more. Creating a bank account with a bank that has it’s own capital is helpful in the future, that we’ll discuss soon.

Most common documents that all banks will need are citizenship, or voter id or passport. Some bank may also require a valid government bill like electricity or water bill as a proof of residence. Also, you must in 18 or above in order to open a bank account in Nepal. In case you are under 18, or want to open a bank account for someone who’s under 18, you’ll need to open a bank account with a beneficiary.

So, once you’ve opened a bank account, you can move on to applying for a Demat account. Let’s move on in the next step to start trading in Stock Market in Nepal!

Create a Demat Account

What is Demat Account?

Whenever you buy stocks or shares of a company, you need a place to store it. That’s where Demat Account comes into play. Demat account is where you hold your stocks. You cannot get started event with IPOs, not the in the secondary market without a Demat account. Hence, Demat account is a necessary step to get started with trading in NEPSE.

So what actually is a Demat account? Simply speaking, it’s where you shold your shares, as mentioned above. A Demat account stands for Dematerialized Account. So what exactly do we mean by “Holds” you shares? In the olden times, there used to be physical trading and holding of share certificated, which was slow and tedious. A Demat account is it’s replacement. In a Demat account, we hold our shares in an electronic form.

Demat Account Details

Just like we need to create a bank account with a bank, we need to create a Demat account with a Depository Participants(DP) licensed from SEBON(Securities Board of Nepal). Currently, many banks and brokers provide this service, so you can request for a demat from your Bank, or your borker of choice.

Most important things to know about your Demat account are BOID number, and CRN number.

BOID(Beneficial Owner Identification) Number is actually like the Bank Account Number. It is a 16 digit number, that comprises of 8 digit DP ID, and 8 digit client ID. Once you have the Demat account, you need to get the CRN number from your bank. CRN (C-ASBA Registration Number) is a unique code that shows that your bank account is liked with your Demat account. Now this is the bank from where amount will be deducted for IPO application, and this is the account where you’ll receive your dividends. We’ll see in detail below how you can receive the C-ASBA or CRN number.

You can not only link one bank account with your demat account, you can register multiple bank accounts with your Demat account. If you link multiple bank accounts, you’ll receive unique CRN number from each bank. If you do so, you’ll have an option to choose bank when applying for IPOs

Get C-ASBA number

ASBA stands for Application Supported by Blocked Amount. In allows for users to apply for IPOs by withholding the applied amount from their bank account. This means that the amount equal to the applied inventment is blocked in users bank account. The blocked amout is released if the IPO is not alloted, and if alloted the blocked amount is deducted from the bank account.

C-ASBA was introducted to make ASBA system more efficient and organized by the CDS. It links all the organizations providing the ASBA service and the beneficiary account in a centralized system, that helps with bank account verification before the application of investor is processed.

CRN number stands for C-ASBA registration number. Any bank or financial institution that provide ASBA service will give you a CRN number that can be used to apply for IPO from their bank account. You can fill up a form to get the CRN number from your respective bank.

So the steps involved in getting C-ASBA or CRN number are:

- Create an account in ASBA member bank as discussed in “open a bank account” above.

- Create DEMAT account as discussed in “open demat account” above.

- Once you have the bank account, fill up the C-ASBA request application form provided by the bank. You’ll need DEMAT account details for this.

- After you submit the form in the bank, the bank will verify your demat account and provide you with the CRN number.

Create a MeroShare Account

MeroShare is where you can see your share transaction details in your DEMAT account. Meroshare is developed by CDSC and it facilitates application for IPO/FPO.

In Meroshare, you can see a variety of details like transaction history, portfolio, bank details, share details, transfer shares, apply for IPO/Right Share online.

NOTE: You can see a comprehensive guide on how to create Meroshare account here: Create Meroshare Account

So now that we know what is MeroShare and why we need it, let see how you can get a Meroshare account. A DEMAT account is necessary to open Meroshare account, hence once you’ve got the Demat account as discussed above. You can proceed to get a Meroshare account.

For getting a Meroshare account, you need to visit your bank or financial institution where you opened DEMAT account and fill up a Meroshare Request form. You’ll need to provide you email ID, contact number, client ID and DPID. The charge for Meroshare account is NRS 50 Annually, however some organization might waive this charge for you initially or for a few years.

Once you’ve submitted the Meroshare account request form, your account will be created within 2-3 working days and you’ll get your username and password through Email or SMS.

Once you’ve received the login credentials, you can login to Meroshare here. It’s highly recommended that you change your password after the first login.

Create a Broker Account

Choosing a Broker

Once you have complete all the steps mentioned above, you are finally at the last step. This is where you’ll create a brokerage account, and you’ll be able to buy and sell stocks.

A brokerage firm acts as a mediator between buyers and sellers in the NEPSE market.

First of all, you’ll need to choose a Brokerage firm where you want to create a brokerage account. At the time of writing this, there are 50 brokers in Nepal. You can choose to create a trading account with any of these brokers.

We suggest to choose a broker that is near to your location so that it’s earier for you in case you have to visit the brokerage office.

Applying for Trading Account

Once you have chosen the Brokerage firm, the next step is to just open the account. Most of the brokers need you to be physically present and fill a physical copy of application form to open a stock trading account, but now a days, many brokers have have also started providing the option to create the trading account online. You can visit the website of the Brokerate firm of you choice to see if they accpet online applications to open trading account. You can also check their contact/call details from Google and call them for this information.

In case you have to physically be present in the borker’s office and give a physical copy of the application, you’ll need to fill two documents. A KYC and An Agreement Form for online trading. You can download these forms from most broker’s websites so you have a better idea of what is required. While filling the forms, you’ll need the following:

- A passport sized photograph

- scanned copy of your citizenship certificate

- BOID

And other personal details.

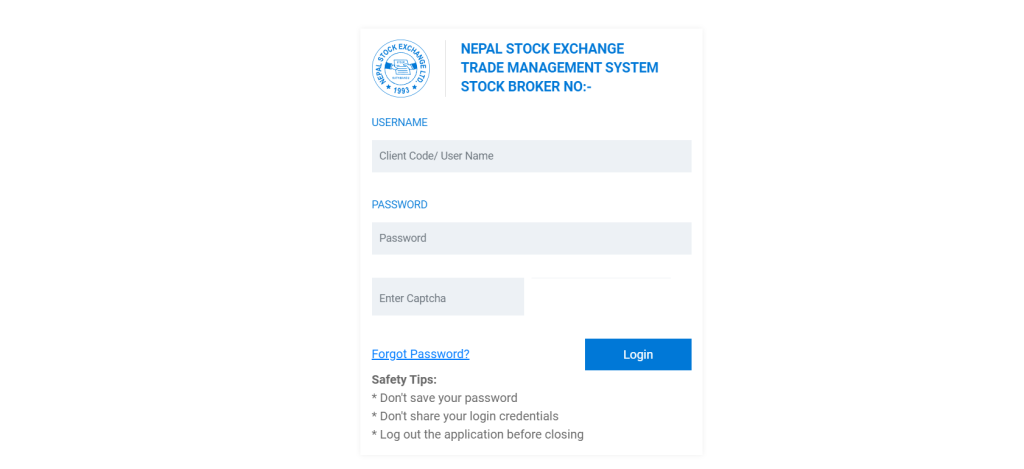

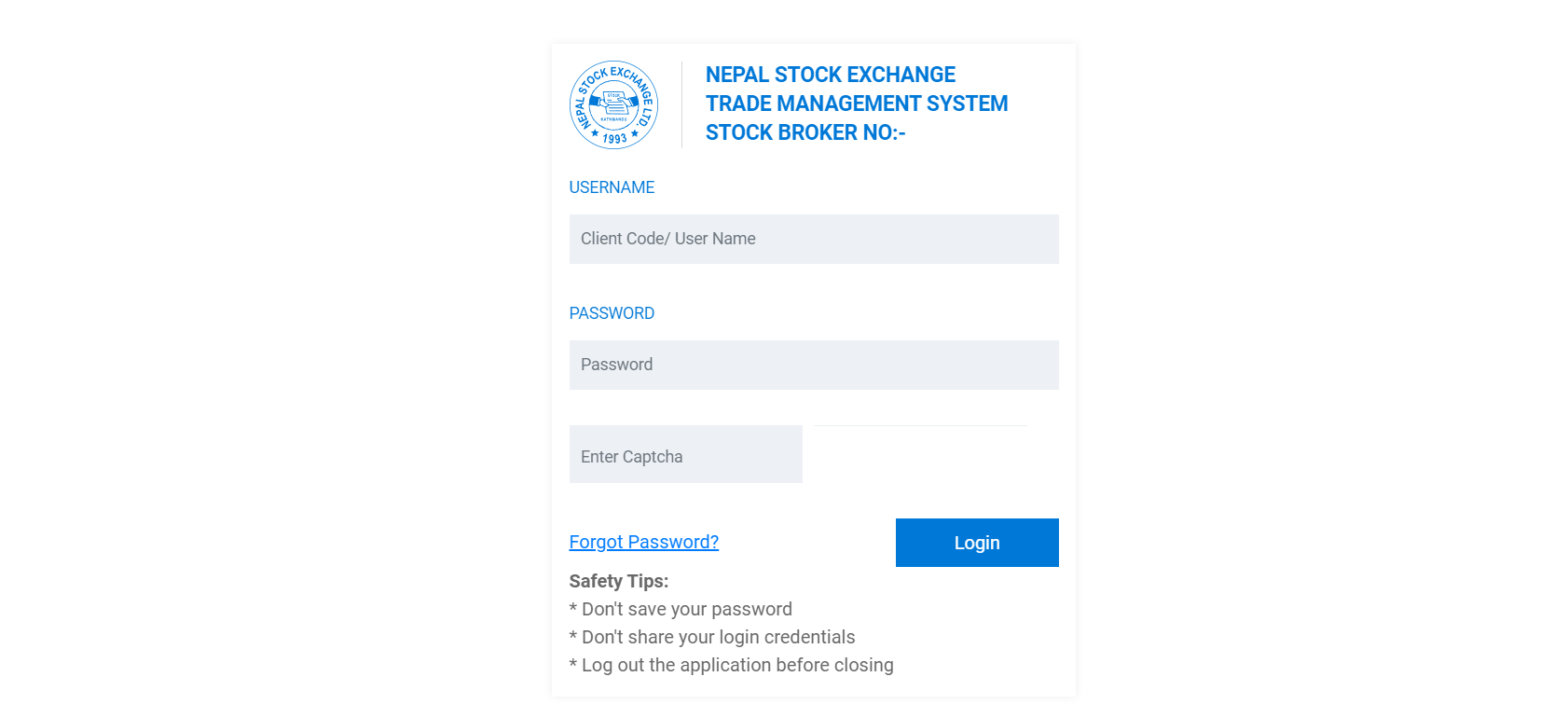

In case you want to open trading account online, you can fill up a the form and register for a trading account in any of the brokers. NEPSE has provided every broker with an online portal for stock transaction. TMS is the official software of NEPSE where you can buy/sell any stock. The TMS website of the broker is in the follwoing format: https://tms.nepsetms.com.np. So if you want to open an account with broker number 13, the TMS website will be: https://tms13.nepsetms.com.np.

Once you have open the TMS website for your Broker of interest, you can just click on the register button to register. There you’ll be asked to enter all the details in the KYC form, and other form filled as mentioned above. You need to scan the other form in digital format, and you have to upload them with the registration form. You’ll also need your passport size photo and citizenship in scanned form to upload it on the registration form for online registration.

Once the application is complete, be it in online or offline way, you have to wait until you receive an email on the email you provided for online trading. We suggest you apply for online trading when opening a brokerage account, however, if you hadn’t applied for online trading, you’ll will have to visit or call the broker office for 10 digits unique client code. This client code is used to buy/sell stocks later on. After you’ve received the client code, you can finally start buying & selling stocks online, or by visiting or calling the brokerage office for buying and selling orders.

If you had applied for online trading account, you’ll receive the client code, your online trading TMS details in your provided email. Feel free to call your broker asking about your application form has been to speed up the registration process, or in case you have any issues.

In this guide, we’ve comprehensively gone over how we can start trading in the secondary market in Nepal from scratch, we think you should have pretty good information by now. It takes a lot of effor to write such long guides, and if you think this has helped you, please feel free to share this with your friends and family.

2 thoughts on “How To Start Trading In NEPSE for Beginners”